THE RENAISSANCE OF BEER

“Cool craft labels, regional favourites and flavour-led big brands are helping to shape the UK beer market in new and exciting ways, as attendees at Cesium Group’s latest ‘Thought Leadership’ roundtable discussed.”

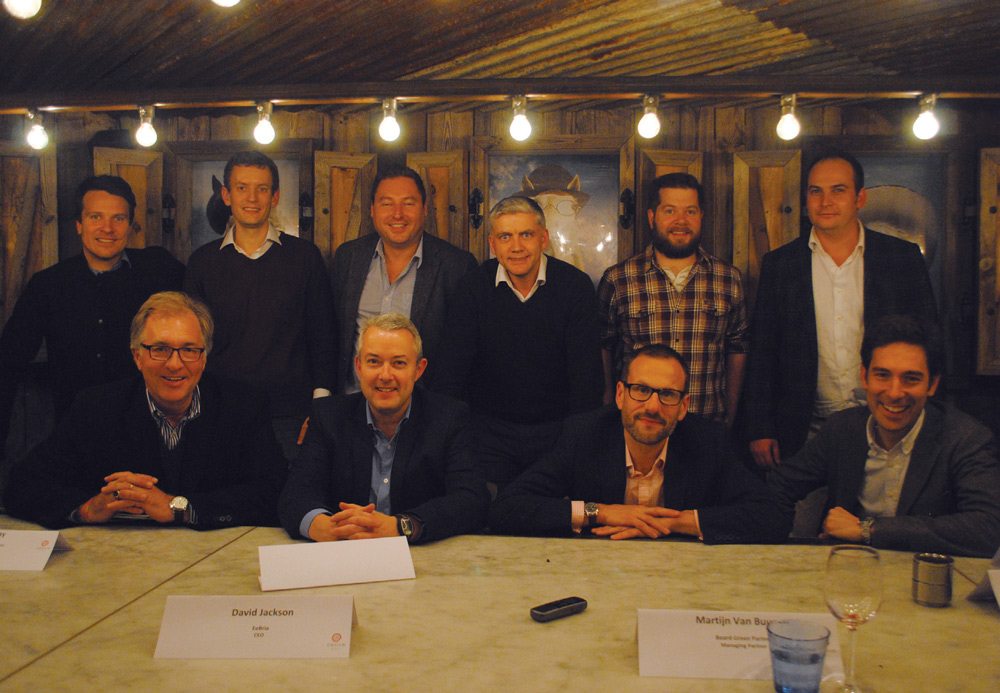

L-R: Jasper Cuppaidge, Martijn van Buuren, David Jackson, James Lousada, Simon Bailey, David Cunningham, Mike Benner, Peter Hills, Paul Haslam, Santiago Fernández

L-R: Jasper Cuppaidge, Martijn van Buuren, David Jackson, James Lousada, Simon Bailey, David Cunningham, Mike Benner, Peter Hills, Paul Haslam, Santiago FernándezTo say that the changing face of beer is a hot topic in the British drinks trade would be the understatement of the (still quite young) year. As recently as a decade ago, the beer industry was threatening to continue heading in the direction of near complete monopoly and flavour homogenisation – but not any more.

Local and regional breweries are stealing a march on more traditional brands’ volume sales at a small but increasing rate – craft alone currently accounts for 3% of sales in the UK. Meanwhile, flavour-led premium brands from large brewers are growing strongly.

And value sales of the more expensive premium brands are more than healthy, as seismic shifts in the way people consume beer – and the venues in which they do so – take effect.

But what are the ingredients that helped to set in motion this remarkable rise of premium pours and independent brewing? What is to say that it will last? Will craft beer eventually occupy the mainstream? And if it does, will it lose the underdog charm that helped get it there in the first place?

The panellists

David Cunningham (chair) – programme director, There’s A Beer For

That, Britain’s Beer Alliance

Paul Haslam – founder/MD, Cesium Group

Jasper Cuppaidge – founder, Camden Brewery

James Lousada – Ex-CEO, Carlsberg UK

Ian Bray – MD, Fullers

Mike Benner – MD, The Society of Independent Brewers (SIBA)

Martijn van Buuren – managing partner, Broad Green Partnership

Santiago Fernández – country manager, UK & Ireland, Grupo Mahou San Miguel

Peter Hills – founder/director, Hackney Brewery

David Jackson – CEO, EeBria

Simon Bailey – MD, Authentic Pub Company

The panel met on 12 November 2015 at The Riding House Café, Great Titchfield Street, London

A NEW PHENOMENON?

First thing’s first: is craft beer even a new trend in the UK, or is it a case of expert rebranding from some regional or even global producers?

Participants were split on this teasing topic, with one saying that no particular brewer or brand has led the rise of craft, describing it instead as an organic process that has led to “a big, seismic shift in the whole beer market and how it’s positioned.”

However, others were not convinced by this, with one guest arguing that craft’s success is simply an example of some brands being able to market themselves in an accessible way to young, millennial consumers, which has been a benefit to clever global brands as much as it has been to small craft brewers.

Guinness was one particular example of a big brand with craft credentials that got people talking. “What is interesting is that they’ve moved into new territory with Hop House 13 and with the West Indian Porter,” one participant said. “Some of it is about heritage, but some of it is brand new.”

“The renaissance we’re seeing is because the beer category is expressing itself in a vibrant and new and different way, which I think is great for beer and it’s great for big brands.”

BRAND BUILDING

For big producers who don’t have a similar heritage to draw upon, their acquisition of craft brewers as a means to get in on the action is another trend that is picking up pace.

Our participants also discussed the best practices that large brewing groups need to remember when buying up small producers, covering the benefits that doing so can bring – and the potential pitfalls.

“You can ring-fence the authenticity and the uniqueness that a small craft brand can bring within a large organisation as long as you’ve got the right people looking after it, with the right passion and the support of that brand right the way through to the top,” one participant said, as they defended the importance of maintaining the input of brand founders within a new parent company’s set-up.

However, this input should not come at the expense of growth, as was generally agreed on by the panel. “When the numbers need to move from 50,000 to half a million hectolitres, it won’t happen with an ‘individual entrepreneurial craftsman’ approach,” said one panel member, “it’ll be through accelerating access to multiple markets around the world.”

DEFINING ‘CRAFT’

However, the growth of craft brands could come at the expense of the category’s raison d’etre, as our participants

were keen to discuss.

One way around this is to simply rebel against the very concept of ‘craft’ as a separate category, something that one of our participants is keen to do: “I got asked to do a talk on this argument a few years ago, speaking about the success of craft and why we’re a successful craft brewer, and I said ‘I’m sorry, we’re not a craft brewery, we’re just a good brewery’, and I think that’s what it’s about.” Our panel agreed the flagship brands that consumers often associate with craft beer are only flagships because they have become international successes.

One said: “I think everything was called a microbrewery. Sierra Nevada was a microbrewery, Sam Adams was a microbrewery; well they’re not microbreweries any more.

“I think they had to come up with different terminology to separate them from traditional beer and call themselves craft.”

And is it even a title that is worth defending? Not according to one participant, who said: “It doesn’t matter what they’re called though, does it? It’s about the consumer. It’s just people in the industry that worry about the title.”

THE TASTE FOR MORE

”Real taste” – that is craft beer’s biggest asset and what helps attract more people to the wider industry as a whole, according to one panellist, who said they so often see younger consumers going into pubs and ordering bitter or cask ale.

“They no longer want the mass-produced lagers: they’re after something that is that premium taste and it’s capturing them.”

The broadening and emboldening of consumers’ tastes was also considered by our panellists as being a big shift for which craft beer can be thanked.

“I don’t think people are constrained to saying ‘I’m a lager drinker’ any more,” said one. “Younger generations now say: ‘I’ll try this today and I’ll try that tomorrow’.”

LOCAL FOOD, LOCAL BEER

Our participants agreed unanimously that just as consumers have begun paying more attention to the origin of their food, so too they have been keeping an eye on where their beer comes from, which plays into the hands of small, craft producers.

“There has been a shift towards people being interested in local food and drink and beer has massively benefited from that,” one contributor said.

But this is not without its challenges. As pubs continue shifting more towards the ‘gastro’ end of the scale, beer’s food-matching potential needs to be put on a high footing to try to break down wine’s hold over the sit-down dining occasion.

One of the participants even said they still prefer pairing wine instead of beer with food, so the scale of the challenge in this area is not to be underestimated.

One contributor commented: “Is there a huge opportunity to tell people about beer and food? Yes there is, and if we don’t we’ll continue to lose share to wine that’s come in and stolen sophistication and the food occasion; cider that’s come in and

stolen the refreshment and spirits that have stolen young people… If we don’t get together as an industry or at least promote ourselves at a category level I think we’ll continue to see a decline.”

And even the trend towards locality could be a dead end, with one participant pointing out that as more brewers open, more consumers could get into a muddle about which beer could be considered more ‘local’ to them.

INTO THE MAINSTREAM

One participant posed what is essentially the crucial question that the often London-centric craft category needs to answer: “We have a phrase in our team called ‘Dave and Debbie from Doncaster’ – how do we reach them?”

It was generally agreed that given craft’s variety, and the excitement surrounding its potential, the wider consumer could be won over.

“Proactively, we need to be trying to get the message out about quality and diversity of taste to a broader audience rather than just talk to beer experts,” was how one of our participants put it, and there was a general consensus that the beer industry too often talks to itself rather than to the outside world.

There is little stopping craft beer from doing this. Large brands have been able to do so in the past with marketing that isn’t too preachy or technical. It is now time for craft to rise to that challenge.